-

-

CBN Gov

More Details -

-

-

Welcome to Nigerian Economic Society

The Nigerian Economic Society (NES) was formed in 1957 by Nigerian scholars as a united platform for Nigerian Economists and allied Social Scientists to provide intellectual leadership in the process of understanding and managing economic, social and political change in Nigeria. The first constitution of the Society was adopted on January 4, 1958. The Nigerian Economic Society organized its first seminar on April 5, 1958 at London and began publishing its main organ, Nigerian Journal of Economic and Social Studies (NJESS) in 1959.

Nigerian Journal of Economic and Social Studies

The Nigerian Journal of Economic and Social Studies (NJESS) is a general-interest economics and social studies journal. The NJESS is the nation's oldest and most respected international scholarly journal in the economics profession and is celebrating over 50 years of publishing.

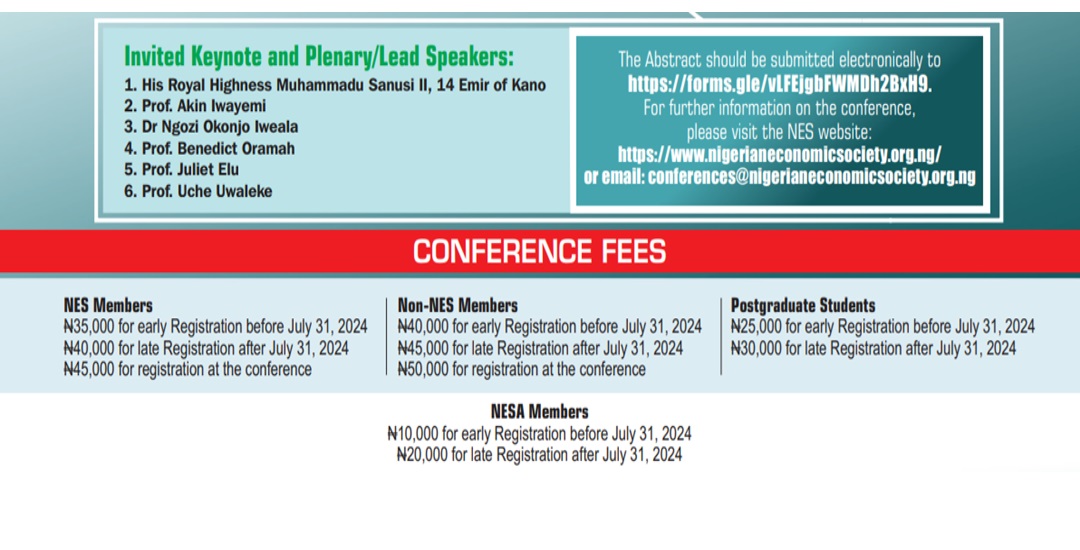

Annual Conference

64thANNUAL CONFERENCE ANNOUNCEMENT

Date: 10th-12th October, 2023

Venue: TBA, Abuja

Conference Theme: Building Resilience for Transformational Recovery.

CALL FOR ABSTRACTS

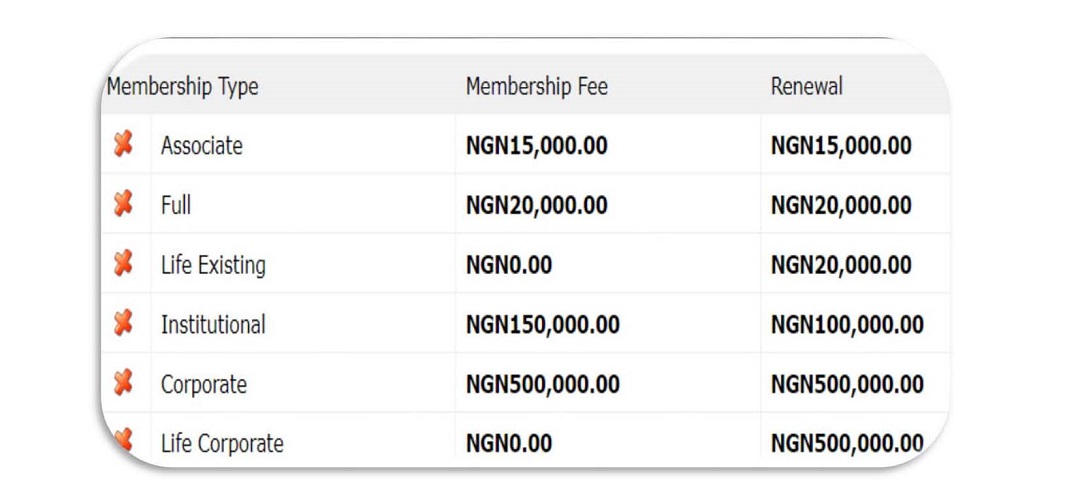

Membership Area

Membership of the Society is open to any graduate of economics or allied subjects (Nigerians and non-Nigerians), or anyone adjudged to be sufficiently knowledgeable in Economics or allied subjects by the National Executive Council is eligible for admission into the Society on application.